280 out of 399 female entrepreneurs, while responding to the question of challenges they have come across in the African market, identified poor access to funds as the most common challenge.

Although investments in African tech have shot up over the years, female participation in the management of these companies and funding of women-led enterprises have been low.

While citing data from the World Bank’s 2018 Global Financial Inclusion database (Findex) on Sub-Saharan Africa, Briter Bridges disclosed that the percentage of women receiving a loan from any source was five percentage lower than that of men; where women take up 43% and men 48%.

A gender gap which they believe is driven

by a combination of firm characteristics, founder attributes, and investor bias.

In a study titled, “Challenges and opportunities for women entrepreneurs in Africa: a survey of science and technology usage“, UNESCO while quoting Morsy et al, 2019, confirmed that, “women entrepreneurs in Africa, in general, and in North Africa, in particular, are more likely to self-select themselves out of the credit market due to low [self-]perceived creditworthiness compared to their men counterparts”

The struggle so far:

In the same study by UNESCO, it was recorded that, from January 2019 to April 2020, 13.4% of African tech start-ups and small or medium-sized enterprises receiving venture capital were (co-)founded by women, yet female (co-)founded companies were allocated 5.7% of venture capital in 2019.

By December, 2020, Briter Bridges recorded that out of the 869 (co-)founding members that raised funding within their company, 17.4% were female.

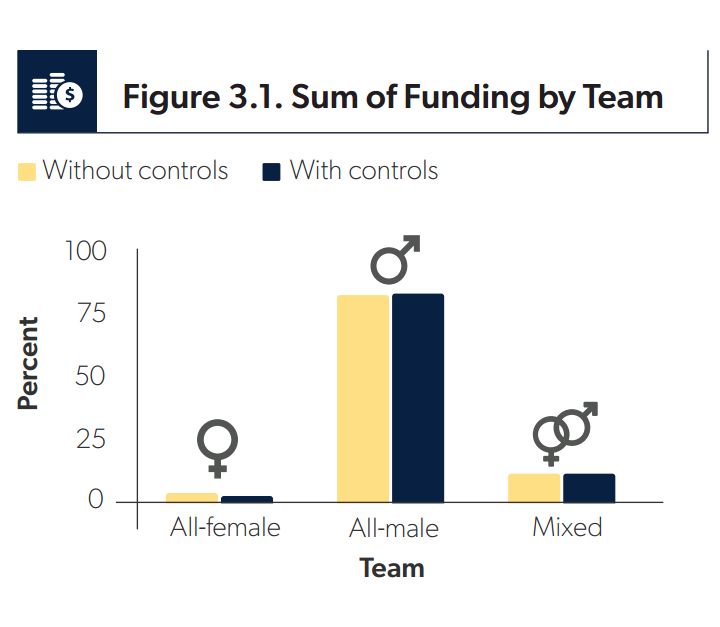

In summary, between January 2013 and May 2021, Briter Bridges uncovered that a total of 1,112 start-ups operating across Africa raised a combined amount of $1.7 billion in early-stage financing. Investments into all-female teams (9% of total startups) made up only 3% of the $1.7 billion, while 76% of investments went to all-male founding teams (75% of total startups).

In other words, this reflects that, for each $1 going to all-female founding teams, all-male teams received $25. This goes to prove just how much of a challenge funding has been for female entrepreneurs and female-led companies in Africa.

How this affects the companies and the tech ecosystem:

In an interview with All Africa, Evelyne Dioh SIMPA, Managing Director of Women Investment Club (WIC) Capital – the first investment fund to exclusively target women-led early stage businesses in West Africa – asserted that although 31% of entrepreneurs in her home country, Senegal, are women, the majority of these women-led enterprises are operating at small scale due to poor funding.

“Majority of women-led businesses are operating at a very small scale,” she said, “generating less than $200,000 USD a year in revenue. And because of that, they are not attractive to banks. We’ve found that about 44% of Senegalese women entrepreneurs who borrow money do so from relatives, and only 3.5% of them use financial institutions to access credit. That is holding them back.”

In the aforementioned report, UNESCO, citing Korchi, stated that, “the funding problem prevents women from recruiting qualified staff, thus forcing them to do everything alone or to hire relatives, which ultimately makes their business local in nature for the most part.”

Statistics have shown that in businesses co-founded by women, for every dollar of funding they receive, they deliver 2.5× more revenue than their male counterparts. And they reinvest up to 90% of their income in the education, health and nutrition of their family and community. In other words, what goes around, comes back around.

“If gender gaps can be closed in labor markets, education, health and other areas, then poverty and hunger eradication can be achieved,” Helen Clark, Administrator, United Nations Development Programme (UNDP) had encouraged in 2016.

Women backing women:

The gap/bias that exists between men and women in the tech ecosystem is like a wound that has eaten too deep into the space to be filled up swiftly. Hence, it has been a slow yet steady run to ensure that women are duly represented in this space.

Initiatives, Venture Capitalists and private investors all across the globe have sprung up and led campaigns to promote female inclusion and ensure that female-led enterprises are adequately supported and funded. A lot of these investors have been recorded to be women who have unwavering faith in their peers and have resolved to take the much evaded risk of investing in them.

This includes firms and initiatives like the Affirmative Finance Action for Women in Africa (AFAWA), Women in Tech in Nigeria (WITIN), Women Investment Club (WIC) Capital, Aruwa Capital Management, Rising Tide Africa, etc, who have invested in so many companies all across Africa. They do not only raise funds for these enterprises, but they also train them and provide the right environment for female-led companies to flourish and expand.

Notable funds raised by African female founders

Healthtracka:

Founded by Ifeoluwa Dare-Johnson in May 2021, is a Lagos-based digital health platform that offers at-home health tests.

From the time of its inception, up until this point, Healthtracka has been aided and funded by female-led VCs.

In December 2021, the company secured an undisclosed amount in funding from Akazi Capital and FirstCheck Africa; both investment firms founded and led by well-meaning African women.

One year after this – earlier this week – Healthtracka successfully secured $1.5 million in a fundraising round led by Hustle Fund, Ingressive Capital, Flying Doctors Nigeria and Alumni Angels Alliance. All of these venture capital firms are (co-)founded by women as well.

Koolboks:

Founded by Deborah Gael, is another female-led company that has enjoyed funding from female investors.

Earlier, in January this year, the France-based company which manufactures affordable solar-powered freezers for Nigerian consumers, raised $1.65 million in a seed round led by Aruwa Capital Management and non-profit venture fund, Acumen to strengthen the company’s team, build a distribution network across Nigeria and procure more technology with which to improve products.

About a day ago, another $500,000 was invested into the company by shell-funded impact investment company, All On. All of these VCs were led by other women.

Edukoya:

In December, 2021, the Lagos and London-based edutech startup, which was founded by British-Nigerian entrepreneur, Honey Ogundeyi, raised $3.5 million in pre-seed funding led by European VC firm Target Global.

Other investors that participated in the funding round included: Kuda‘s co-founders – Babs Ogundeyi and Musty Mustapha; Paystack‘s CEO, Shola Akinlade; Stash and Auxmoney.

The way forward:

The road to positive development in every sector of Africa begins with diversity, equity and Inclusion. Because inclusiveness without adequate support (financially and psychologically) is no inclusiveness at all.

We need to hone the talents in women and diversify our workplaces. We need to completely erase the mentality that ‘women are meant to be seen and not heard’ and explore the idea that women can do much better when given an equal chance.

“The glass ceiling, though cracked in many places, is far from being shattered. Gender requirements in selection and recruitment and incentive mechanisms for retention can enhance women’s representation in the public and private sectors. Mentoring, coaching and sponsoring can empower women in the workplace by using successful female senior managers as role models and as sponsors,” according to the Human Development Report 2016.