Over 200 million banked and unbanked Nigerians are paying the price for the Central Bank of Nigeria’s (CBN) naira swap policy. Cash scarcity is at its peak, and small and medium-sized enterprises are shrinking and shutting down as the inflation rate skyrockets.

So far, the downsides of this cash swap and cashless policy appear to outweigh its advantages and the question remains, “how prepared are Nigerians for a cashless economy?”

What you need to know

The policy, which follows the redesign of the country’s ₦200, ₦500 and ₦1,000 notes, was announced by President Muhammadu Buhari and the CBN in November 2022. Consequently, all old naira notes are to be deposited and returned to the apex bank where they can be completely restricted from circulation.

Over the year, the deadline for the submission and/or use of old naira notes has been reviewed, postponed and reviewed again. Both the state governments and struggling citizens of the federation have pleaded and requested more extensions and lenience, but the apex bank has been resolute; their policy is still in motion.

Unlike in the earlier days of the policy implementation when Nigerians could deposit old notes at any bank of their choice, the new guidelines for old notes submission requires depositors to fill forms on the CBN portal, generate codes, among other things, to submit directly to the CBN alone.

Furthermore, the policy also restricts individuals and corporate organizations to a weekly ₦100,000 and ₦500,000 cash withdrawal, respectively, over the counter (OTC); and a ₦20,000 daily withdrawal limit at any and every Automated Teller Machine (ATM) across the country.

The goal versus the results

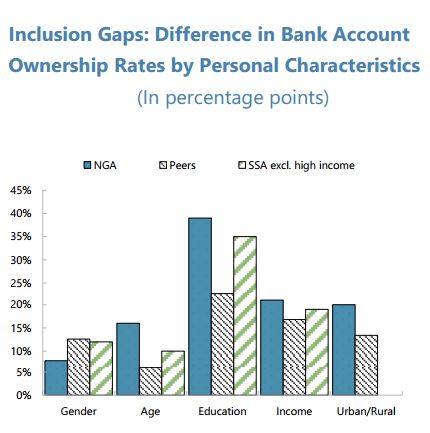

The framework for the CBN’s cashless policy was first introduced in 2012 to reduce the amount of physical cash in circulation, thus, deepening financial inclusion by driving digital payments, reducing fraud and eliminating cash-aided crimes such as terrorism, banditry, extortion and ransom settlement. However, the CBN and the federal government had failed to foresee the current upheavals which this new policy has reeked within the economy.

Although ransom settlement rates have indeed declined since the policy’s implementation, the country’s inflation rate has increased by 6.22% to 21.82% in January 2023.

The National Bureau of Statistics (NBS) in their recent inflation report found that the urban inflation rate of Nigeria in January 2023 was 22.55%, while that of the cumulative rural areas of the federation amounted to 21.13%, amidst the current naira scarcity.

In Sokoto and other northwestern states of the federation, reports have shown that traders, and small and medium-scale entrepreneurs have been forced to reduce the cost of food items to encourage patronage. In the nation’s capital, however, the price of food items as well as other commodities are still as rigid as they were in December 2022.

Where electronic transactions are expected to be making the most progress, point of sale (POS) operators have taken to extortion amidst the ongoing socio-economic upheaval.

Across the country, POS operators have resorted to demanding from customers exaggerated interest rates, reaching over 10% for every transaction. Notwithstanding, POS transactions in January 2023 had upscaled by 40.69% year-on-year increase to N807.16bn.

What are Nigerians doing?

Where ATMs rarely have enough cash to dispense and bank queues are in themselves becoming longer and more frustrating as the days go by, even the banked Nigerians bear the cross of this policy, almost as much as the unbanked populace.

A brief chat with some persons in the city of Abuja got me to understand that the buying and selling of new notes have become a thriving venture among Nigerians. In this case, sellers with access to cash, such as traders and micro-entrepreneurs who still receive payments in cash, subsequently sell their excess cash to buyers who pay in percentages and/or other valuables.

This ongoing trend among these traders and POS operators has caused more harm than good for many Nigerians.

Reported cases of hoarding by some commercial banks have also contributed to this chaos and upheavals. Consequently, the Fintech Association of Nigeria has warned that challenges with the implementation and execution of the CBN’s cashless policy may destroy customers’ trust in the country’s banking system.

eNaira amidst this rising tide

As the official Central Bank Digital Currency (CBDC) of Nigeria, the eNaira is expected to be the best new alternative for the Nigerian people in times like these. Its purpose is to proffer a fast, safe, easy and cheap means of payment for both banked and unbanked Nigerians in a cashless economy. As a digital copy of the physical naira, the eNaira acts as a unit of account, a store of value and a medium of exchange.

However, through the chaos of this cash swap saga, the country’s digital legal tender has had the lowest patronage yet. As revealed in a report by the International Monetary Fund (IMF), the eNaira adoption rate among households and merchants has been low with only about 8% of eNaira wallets in use. In effect, it is evident that the cashless policy at this point is more of an absonant decision than it is a strategic plan to boost the nation’s economy.

Going forward

While this new policy is a laudable approach to the arguments raised by the CBN and the federal government, critics, as well as other key stakeholders in the national economy are suggesting the redefinition and restructuring of its execution and implementation process.

As the 2023 general elections scurry toward us, Nigerians are optimistic that things should eventually get better. With hope on the horizon, all fingers are crossed and eyes peeled to see what this new dawn will bring to the Nigerian economy.