Nigeria has over the years grown to become Africa’s technology hub with financial inclusion as a front burner in government policy. However, there is still more to be desired as just a little over half of the population is banked with conventional financial service providers, and obviously the services being rendered by banks fall grossly below margin. The reason for this shocking statistics may not be far-fetched after all, considering that traditional banks remain the major drivers of financial activities, with fintechs still a nascent sector.

However, over the years, there have been laudable measures taken to achieve financial inclusion including the adoption of the rural banking programme in the late 1970s; the development of varied financial products; enhancement of payment processes; development of credit system; and encouragement of a savings culture. But even these haven’t been enough to reduce the number of the financially excluded. As it currently stands, 40% of its 200 million population are underserved, a mere 6.3% decrease from the 46.3% it recorded in 2010 based on an EFInA 2010 financial access survey report.

Financial Inclusion: a state where financial services are delivered by a range of providers, mostly the private sector, to reach everyone who could use them.

The role of fintech in driving financial inclusion:

Financial Technology or fintech as they are more popularly known refers to the use of modern technology to allow for seamless operations. A stroll through history shows that the operations of fintech started when Nigerian banks began incorporating advanced technology into their banking. Fintech is mostly mistaken with banking institutions but they are both different entities. However, unlike these bodies, fintech organisations are known for their flexible operations and ability to move with technological changes in the sector.

Fintechs perform operations similar to banks including payment processing, credit scoring, savings, lending and cross-border trading. By the time of this report in 2022, Nigeria is home to over 200 standalone fintechs and hosts 5 of the 7 unicorns in Africa including, Andela, Flutterwave, Interswitch, Jumia and Opay.

The growth of fintechs in Nigeria did not happen overnight, and according to a McKinsey report, it was fueled by a youthful population, increasing smartphone penetration, and a focused regulatory drive to increase financial inclusion and cashless payments . Behind the scenes of the fintech companies lie careful research, planning and funding to make financial services more accessible to the populace. This populace comprised of customers who were not satisfied with banking systems or who needed a less-expensive payments facilitator as opposed to the high charges and constant bank deductions seen in conventional banking systems. In Nigeria, it is no new thing to have funds deducted from one’s account or for a transaction to be incomplete along payment gateways with debit from one end and no corresponding credit on the other side.

With fintechs however, hassles are minimal and it is gradually edging out financial exclusion through the following means:

Access to Credit:

In Nigeria, Small and Medium-sized Enterprises (SMEs) contribute 48% of national GDP, account for 96% of businesses and 84% of employment. Despite the significant contribution of SMEs to the Nigerian economy, access to credit remains a pain point to SMEs as merchants are oftentimes unable to afford the interest rate on bank loans, provide adequate collateral or have a guarantor sign up for them. With the introduction of fintechs, SME merchants can access quick, unsecured loans without the paperwork involved in traditional bank loans. Fintechs use algorithms to build a credit score for customers with no previous financial history and reduce risk of fraud.

Increased savings: Certain fintechs enable customers to earn more money for savings. Kuda for instance enables its customers to earn as they spend.

Fintechs are also working at promoting a cashless economy through their digital payment facilities. The use of AI enables fintech companies to verify and transfer payments instantly. Fintech companies use a variety of technologies, including artificial intelligence (AI), big data, robotic process automation (RPA), and blockchain to process financial information.

A 2021 Disrupt Africa report shows the making of several of these unicorns. With expansion flying at breakneck speed, many of these payment facilitators have lessened the percentage of the underserved population.

Underserved: underresourced; not having sufficient service.

Challenges faced by fintechs:

Presently, the tech world is shifting its paradigm towards international expansion and members of the rural community who contribute to a greater percentage of the underserved population are still left behind.

Following the penetration of smartphones into the Nigerian market, several youths have taken to the internet to operate businesses. According to The Guardian, Nigeria has roughly 170 million mobile phone users based on subscriptions. However, only 10 to 20 percent of the population uses smartphones while the rest rely on more traditional mobile phones, thus limiting their options to voice calls and text messages.” What happens to rest 80%? How can one access a fintech platform without owning a smartphone or being able to operate one?

In the country, 40% of women who did not own a mobile phone identify illiteracy as a key barrier to ownership, compared to only 22% of men. Over the last few years, access to the internet increased from 43.01% in 2017 to 53.51% in 2022. However, digital illiteracy remains a mammoth-sized problem in the country despite the Federal Government’s claim to be able to shoot the digital literacy rate to 95% by 2030. Presently, only the digitally savvy can effectively operate a smartphone well enough to use a fintech as they are majorly operated via their mobile apps and web platform. Consequently, a majority of the SME merchants (women) usually with a limited education are excluded from benefiting from the advantages fintechs offer.

When asked if he preferred using a traditional bank to a fintech, Ojochegbe said, “These days people use more entrepreneurial fintechs than banks because of the better user interface and these companies accept crypto currency and accept foreign currencies.” But what percentage of the populace is digitally literate enough to figure out what this means?

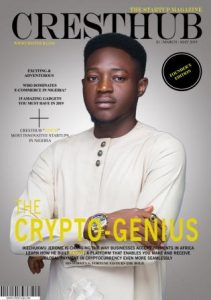

Another hindrance to the drive of fintech in rural areas is the distrust of online platforms. Statistics come in handy when trying to get an estimate of a phenomena. And with regards to frauds and scams, the stats are overwhelmingly negative. In 2019, fraudulent activities were carried out mostly through the web (51 percent), mobile transactions (35 percent) and ATM (20 percent.) Also, in 2020 many Nigerians were defrauded through the web (47 percent), mobile transactions (19 percent) and ATMs (9 percent). This factor increases the fear of millennial netizens who ‘have a mindset that everything that concerns online activity are scams’ as Ephraim stated in a chat with CRESTHUB. More is the number of millennials who would have nothing to do with online banking systems. Thus, traditional banking still holds a greater appeal for SME merchants who are majorly millennials.

A contributing factor to this underservice in the rural region is the lack of proximity of fintech branches to these areas. Seeing, as many in Nigeria agree, is believing. If Oja Amina cannot see the company she is banking in, she would rather stick to the visible ones. While still trying to find his way around fintechs, Bebe said he “would not leave a huge sum in neobanks because they might run.” This notion is not surprising following the recent collapse of 86fb .

The potential of financial technology in Nigeria remains to be fully tapped and despite its slow growth rate in filtering at the rural areas, fintechs remain the best bet to creating a financially inclusive Nigeria.