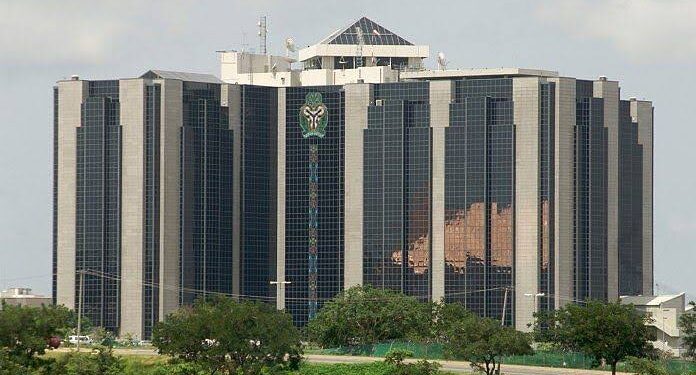

The Central Bank of Nigeria (CBN) has mandated all foreign banks to refrain from offering banking services.

This was announced in a Guideline Draft to financial institutions with headquarters outside Nigeria.

The apex bank stated that it is setting the following guidelines for foreign banks which were mandated to get their pre-approval before operating in Nigeria.

While CBN recognizes the importance of foreign companies drawing capital to the nation, it emphasizes that guidelines are necessary to clearly define the scope of their operations.

Consequently,

Foreign banks and other financial institutions seeking to set up an approved representative office in Nigeria are required to write to the office of the Governor of the CBN.

Representative offices of foreign financial institutions are also authorized to be opened in Nigeria for an application fee of N5,000,000 and payment of a non-refundable license fee of N10,000,000 made.

However, the approved representative office is still prohibited from engaging in banking or any other regulated activity in Nigeria.

The Apex bank stipulated that foreign financial institutions will be barred from offering the following services

- Provision of any commercial or trading activity that may lead to the issuance of invoices for services rendered.

- Acceptance of orders on behalf of the foreign parent.

- Engage directly in any financial transaction.