Bento – a pan-African digital payroll and HR Management (HRM) platform, has today announced its big break into three new markets, establishing a solid presence in Ghana, Kenya and Rwanda to grow the company’s reach across the continent.

The payroll and HR Management platform which was founded in Nigeria in 2019, sees the market in Africa as a huge untapped opportunity with over 400 million people in the labour force. This however, would give African businesses a shift from the normative form which has remained largely analogue up until now, using spreadsheets and bulk upload on bank portals, bank transfers, cheques, and even cash.

Bento is bringing African payroll and HRM into the digital age and ensuring that different market participants are communicating and leveraging data to help unlock credit solutions.

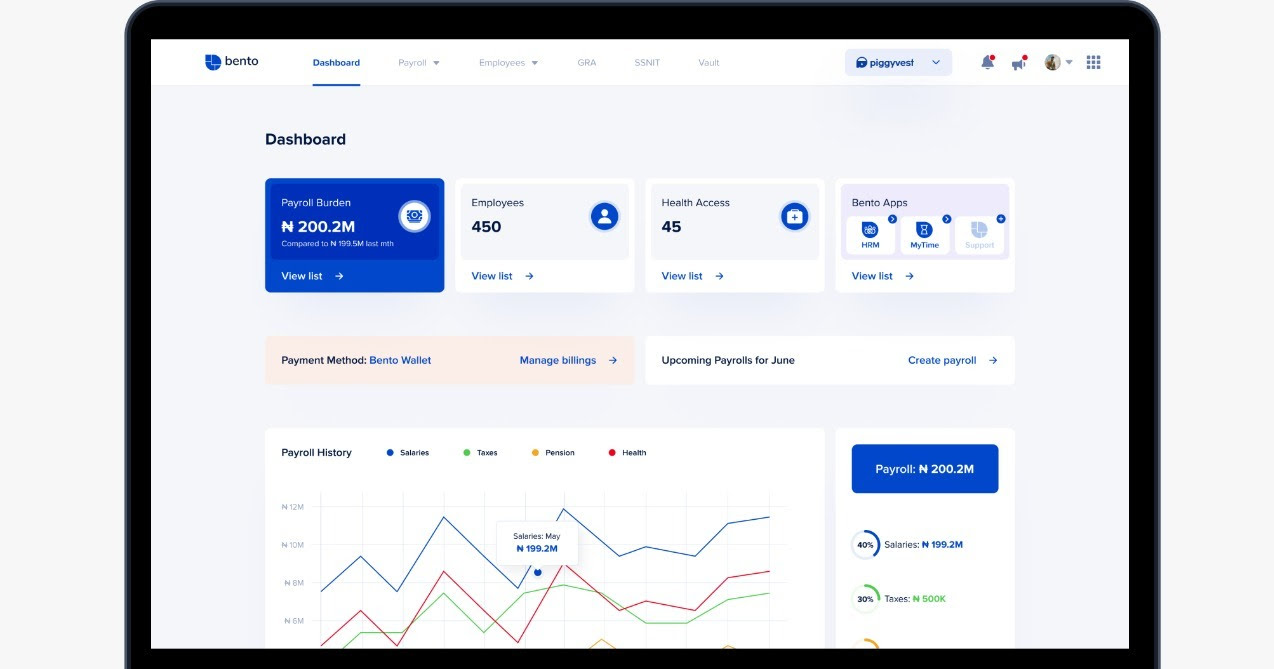

Bento addresses many of the challenges African businesses face in terms of taxes, salary payments, pensions, etc. Through its cloud-based platform, Bento empowers African businesses and gives them peace of mind by streamlining many of their processes with a single click.

For employees, the platform offers access to third-party services such as credit solutions – which include the ability to pay school fees and rent monthly rather than yearly – unemployment insurance, savings, investments and much more, all at no cost to employers.Having obtained full operating licenses in each market, Bento is building local teams in Ghana, Kenya and Rwanda and will adapt its products for local cultural and financial nuances.

In Nigeria, Bento has stood at the forefront of payroll and HRM, serving over 900 active Nigerian businesses across all sectors, including some of the largest Healthcare and Financial Services companies in the country such as Hygeia and Tangerine Africa, as well as many Combinator-backed firms including Paystack, Kobo360, Branch, Helium Health, and LORI Systems.While solving the missing piece of the B2B payroll and HRM puzzle, Bento is also enabling employees to access credit solutions and other third-party products and services.

Around 95% of African consumers have never had access to formal credit and rely on informal lenders and savings schemes.Per theglobaleconomy.com – The average for 2017 based on 39 countries was 4.47%, approximately, a 4.5% figure in Africa in comparison to the 65% in the US. Bento’s proprietary credit engine was built in partnership with Tarya, Israel’s largest P2P lending firm, ensures the company can offer significantly better rates than traditional retail lenders and disburse within minutes rather than days.

Bento can be accessed by employers through its secure, cloud-based web platform and its mobile app for employees, available on the iOS App Store and Google Play Store.

The company is targeting further rapid growth across the continent and will launch in Egypt, South Africa, Uganda, Tanzania, Angola and Senegal by the end of Q4 in 2022.

Ebun Okubanjo, Co-Founder and CEO at Bento said, “Seeing so many companies using analogue methods to manage their workforce is simultaneously frustrating and exciting for us. Employers don’t have access to locally customised, world-class payroll and HRM tools, and employees can’t easily access third-party services to help make life easier. When you think about it, your salary powers your life, so we’re building the operating system that will have a profound impact on the African continent for generations to come.”

In response, Chidozie David Okonkwo, Co-Founder and COO at Bento said, “We’re starting with payroll and HRM, but moving rapidly towards Salary 2.0, where we redefine the intersection of work and life and transform the way people earn, spend and borrow on the continent. Having successfully established product-market fit in Nigeria, one of the most difficult markets to penetrate in Africa, we’re excited to roll out across the continent and solve the real problems we know millions of employers and employees face on a daily basis.”