Telecommunications giant, MTN Nigeria, has announced the final approval from CBN to commence financial operations as MoMo Payment Service Bank Limited (PSB)

The company disclosed this information in a press release signed by Uro Ukpanah, the company’s secretary.

In line with recent developments, the company said in a statement: “MTN Nigeria affirms its commitment to the CBN’s and the Federal Republic of Nigeria’s financial inclusion agendas, and we are excited at this opportunity to assist in their implementation”.

However, the date of commencement of operations will be communicated to the Central Bank of Nigeria as per its requirements.

What MTN’s PSB Licence Approval could mean for Nigeria

In November last year, the Central Bank of Nigeria (CBN) had granted approval in principle to MTN and Airtel to operate a Payment Service Bank (PSB) across the country, with the purpose of further enhancing financial inclusion in Nigeria.

The approval was the first step towards a final take, provided that certain conditions as stipulated by the apex bank are met.

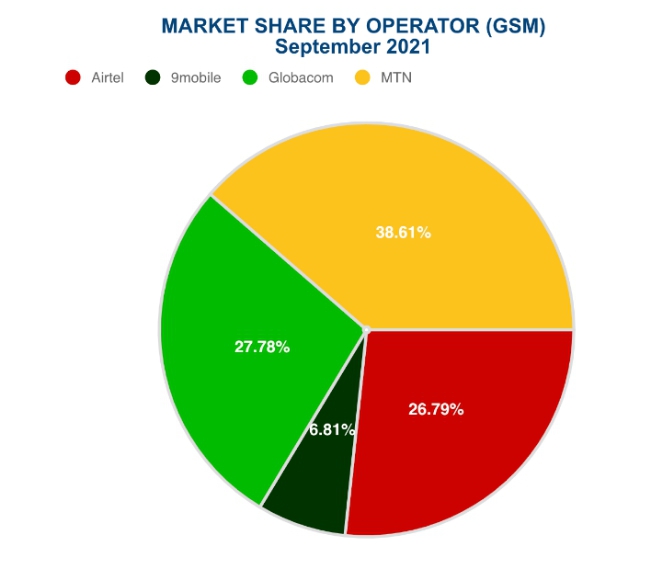

With the Nigerian Communications Commission market share by operator (GSM) in September 2021 showing a leading figure pack of MTN ranking at 38.6%, as the highest telecommunications service used; it is only expected that MTN’s massive infrastructure, and penetration into communities would drive the goal of financial inclusion in the nation easier.

What it Means to be Financially Included

Since 2012, the often stated goal of the Central Bank of Nigeria has been to deepen financial inclusion in the country, mainly because in developing economies (such as Nigeria) many people are excluded in various ways from financial services.

According to the World Bank, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs, while delivering transactions, payments, savings, credit, and insurance in responsible and sustainable ways. And when citizens are financially empowered, the country’s economy can advance.

While a large number of Nigerians have access to financial products and services such as bank accounts, pensions, loans and insurance products, a 2020 EFInA Survey reveals that 38.1 million of the Nigerian adult population do not have access to basic financial requirements.

The Frenzy around PSB’s

While the direct participation of telecom companies in Nigeria’s mobile money licensing system was restricted a few years ago, the central bank, after years of consultation and participation, is exploring a new mechanism to enhance financial inclusion.

She believes that issuing PSB licenses to companies in the country will increase financial inclusion, particularly in rural areas and facilitate transactions.

This is because Payment Service Banks (PSBs) will enable the facilitating of payments for current and savings accounts, offer payment and transfer services, issue debit and prepaid cards, and deploy ATMs and other technology-enabled banking services at an easier and faster pace.

PSBs will be able to target the underbanked and remote communities to facilitate life financially anywhere in Nigeria where there is a network of connections. Bringing along with it, its advantages from promoting a Nigerian cashless society initiative, to safe deposit of funds, investment programs, and many other things.

With CBNs’ plans to integrate rural communities and the unbanked population into the nation’s overall banking system, the excitement and future developments of MTN’s approval to operate financial services like MOMO is something to look forward to.

Final Note

Payment Services Banks (PSBs), register great potential to drive financial inclusion forward through its significant strengths which include, large amounts of capital, strong brand presence, technological advancement, market presence, among many other things; thus, it has placed Nigeria in the spotlight as it currently has four major mobile networks that operate Payment Service Bank (PSB) branches.

They are Globacom Limited with MoneyMaster PSB Limited; 9mobile with 9PSB Limited; Airtel Africa with Smartcash PSB Limited; and MTN Nigeria with MoMo PSB Limited.