Octamile – a startup that offers infrastructure solutions for the provision of digital insurance in Nigeria, has secured the sum of $500,000 in its pre-seed funding to launch fully, after building in stealth over the past few months.

The funding round was led by EchoVC with participation from Fiat Ventures, Kesho VC, Trade X, Verraki Partners, Dale Mathias, Kyle Daley (founding team member of Chime), and other local and international angel investors.

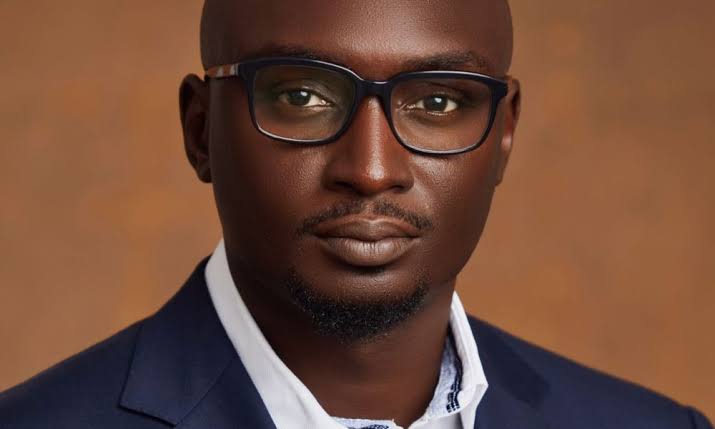

Founded by Gbenro Dara (an innovator in the online and technology industry), Octamile’s ecosystem of services helps both insurance and non-insurance businesses protect African consumers from financial losses.

The startup offers an end-to-end claims management solution that can be integrated into the existing systems and processes of insurance providers. This enables organisations to provide a seamless claims experience while reducing administrative costs. In addition, Octamile provides data, sourced from its diverse partners, which providers can leverage for improved risk profiling and pricing of customers’ assets to optimise the profitability of their insurance portfolio.

Per TechCabal, Dara explained that Octamile’s objective was to reduce friction in the insurance experience to provide from financial loss. “Our solution covers first notification of loss, remote inspections, rule-based decision-making, and payments”, Dara further explained.

Using Octamile’s customisable APIs, non-insurance businesses and developers can add insurance by ‘default’ as a feature in their products or services. “No one wants to buy insurance, but everyone needs it,” Dara said. “Insurance can be easily consumed if provided at the point of particular need. With our APIs, all types of businesses can easily embed insurance as a feature while we do all the backend and paperwork.”

The insurance sector is one with significant untapped potential in Nigeria. In an economy of over 200 million people, insurance penetration has remained at 1.5% ranking Nigeria as 87th in world terms.

With a degree in insurance from the University of Lagos, being a Member of the Chartered Insurance Institute of Nigeria, as well as a decade-long experience in leading roles at various technology startups, Dara is very well familiar with the potential for technology to address challenges in the insurance space.

“I have a background in insurance and understand the challenges,” he said. “Having spent the last decade leading and building technology businesses and exploring multiple business models and industries, I believed it was finally time to tackle the big elephant in the room that no one wanted to tackle.”

Quite a number of insurance-focused technology startups are springing up across Africa but Dara believes Octamile stands out as the startup is enabling not just insurers but also non-insurance businesses to simplify access for Africans.

According to him, the insurance industry has lagged in the use of technology to deliver better products and services. “Growing up, I had personal experiences of how insurance can positively impact your life and believe every Nigerian and African should have access to the same,” he said. “Our team has identified key areas where we add value and support the growth of the insurance ecosystem with data and technology.”

Over the next months, Octamile’s team of 12 members plans to work closely with its partners, including AXAMansard and FirstBank, to onboard the “dozens of insurers and startups” on the waitlist ready to use its solutions.

In the long run, Dara sees significant growth and increased uptake of insurance products among Africans, driven by technology and improved connectivity. “Insurance is one sector that has the power to elevate the economy,” he added.